This is my first blog post related to personal finance, but it's one of my favorite subjects to read about and discuss. I've loved numbers and math since a very young age, and personal finance gives me the opportunity to plan and strategize with numbers. What could be more fun? Needless to say, not everyone reads that question without thinking of a long list of things that would be more fun for them. My better half is one of those people, so I manage our household finances while she remains blissfully unaware. Like many other couples, that arrangement works well for us.

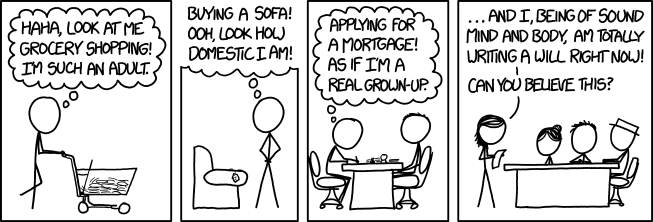

Although I enjoy planning for our future, there's one event no one likes to think about: their own death and/or their partner's. You could be the most fit 138-year-old the world has ever seen and still get hit by a self-flying car one day. Without a plan in place, your loved ones could be left not only grieving but panicking as well. I can only imagine how difficult it would be for the little woman to take over our finances even if I were here to answer questions. Going solo without my help would be a total mess. What about you: would your spouse or partner be prepared? What if the scenario were worse due to dying together in an accident or very close in time? In that situation (or for single people), someone even less familiar with your finances such as a child or parent would have to figure things out.

That's why estate planning is crucial. It doesn't matter how many decades you spend planning your future if you ignore the one event that's guaranteed to happen. We bought life insurance several years ago and the process was less painful than I expected it to be. Yet we haven't created wills or done much estate planning at all. After the recent death of her aunt, the wifey was concerned about how much she doesn't know in regards to our accounts. Whom should she call to claim the life insurance, what are the policy numbers, how would she pay the electric bill? Yes, those were all real questions. I had a list of the major information I thought she would need, but it was severely outdated and she'd never even seen the list.

I sat down recently to address those concerns. It took hours to improve the spreadsheet, verify the details that were already there, and add new accounts. Needless to say, it was worth it. We both feel 100% better just knowing the information is compiled in one place with notes. If you've yet to make a similar list of your own, you can download the Estate Planning Organizer for LibreOffice Calc or Estate Planning Organizer for Microsoft Excel to get started. It provides worksheets to enter details about insurance policies, banking/other accounts, and utilities. If you find it useful or have ideas for improving it, I'd love to hear from you.

I have a solid grasp on personal finance overall, but estate planning is completely new territory for me. As we continue to make progress, I may post more about what we learn. We still have a lot of work to do—most notably the much dreaded creation of wills. This is a great start that provides some peace of mind, though. Not to mention, it allowed us to spot a few changes that needed to be made immediately. If you're further along with your estate planning, I'd appreciate any suggestions or warnings in the comments below.